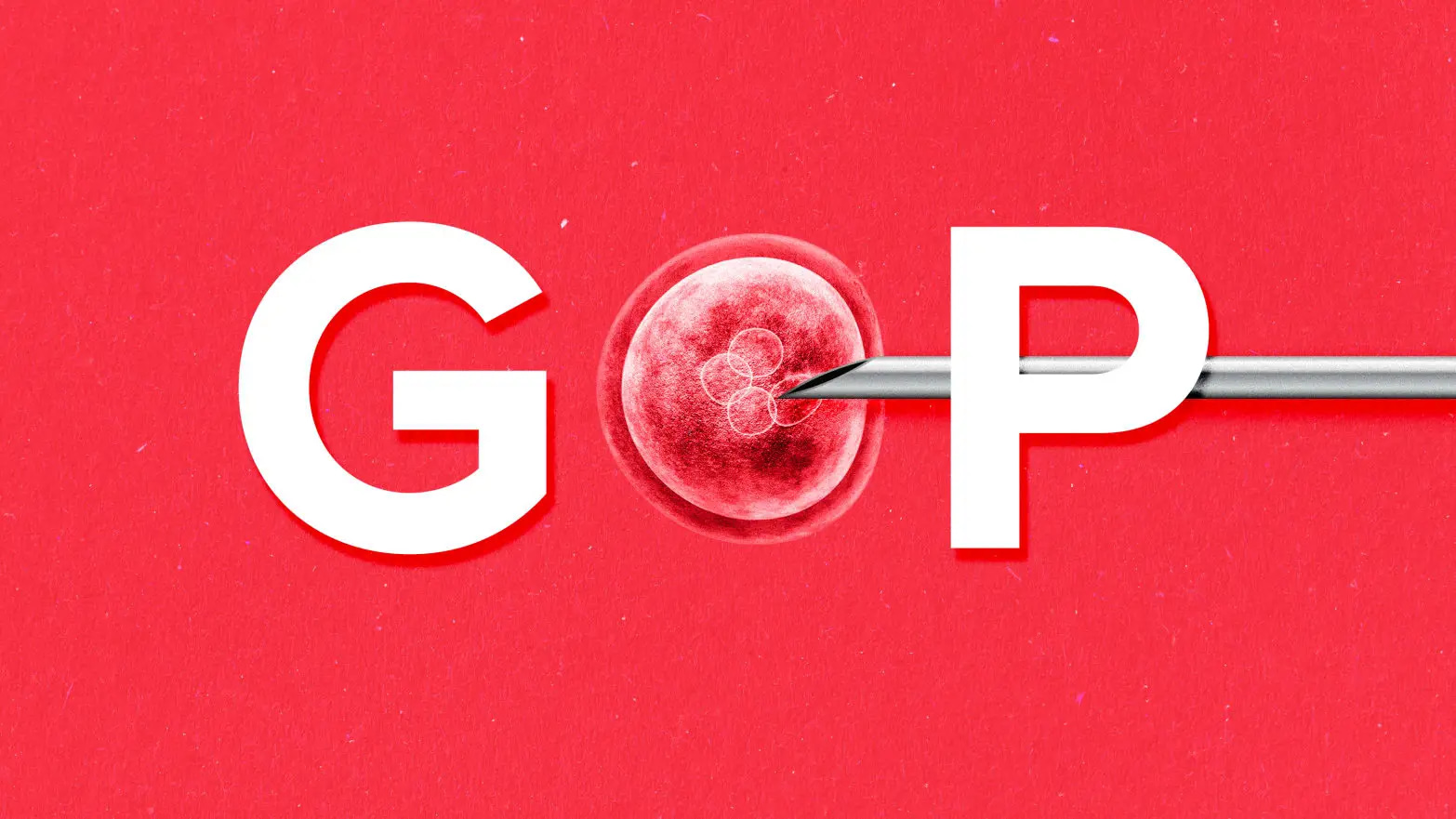

Republicans are learning that IVF is, to borrow from Joe Biden, a BFD. In the two weeks since the Alabama Supreme Court shockingly ruled that frozen embryos are children, polls show that the American people overwhelmingly disagree. A CBS News/YouGov survey found that 86% believe in vitro fertilization must remain legal. In response to that […]